Giving to MCH

At Monadnock Community Hospital, every breath, every step, and every story matters. In Every Breath a Victory, Bruce Barsalou’s incredible journey from struggling with every breath to walking toward a second chance at life shows the true impact of compassionate care, expert rehabilitation, and unwavering community support. Your generosity makes transformations like Bruce’s possible—helping neighbors reclaim their lives and find hope where it’s needed most.

Watch Bruce’s story. See how your gift can help change lives.

Laura A. Gingras, CPA, CFRE

VP of Philanthropy and Community Relations

Email: Laura.Gingras@mchmail.org

Phone: 603-924-4666

LeeAnn Clark Moore

Director of Philanthropy, Marketing, and Community Relations

Email: LeeAnn.Moore@mchmail.org

Phone: 603-924-1700

Thanks to generous philanthropic support from donors like you, MCH is able to meet the ever changing needs of our community day after day. Our compassionate physicians and staff offer the highest quality services utilizing the most current technology and equipment. Because of you, MCH will be here when you, your loved ones, and your neighbors need us most and for that we are grateful.

Philanthropic support Goes a Long Way

As a not-for-profit hospital, Monadnock Community Hospital is deeply committed to providing compassionate, high-quality care for everyone in our region

Financial Assistance Program

Thanks to your gifts, our Patient Financial Assistance Program provides support to over 1,700 community members each year.

State of the Art Equipment

With your donations we are able to purchase new state-of-the-art equipment and technology.

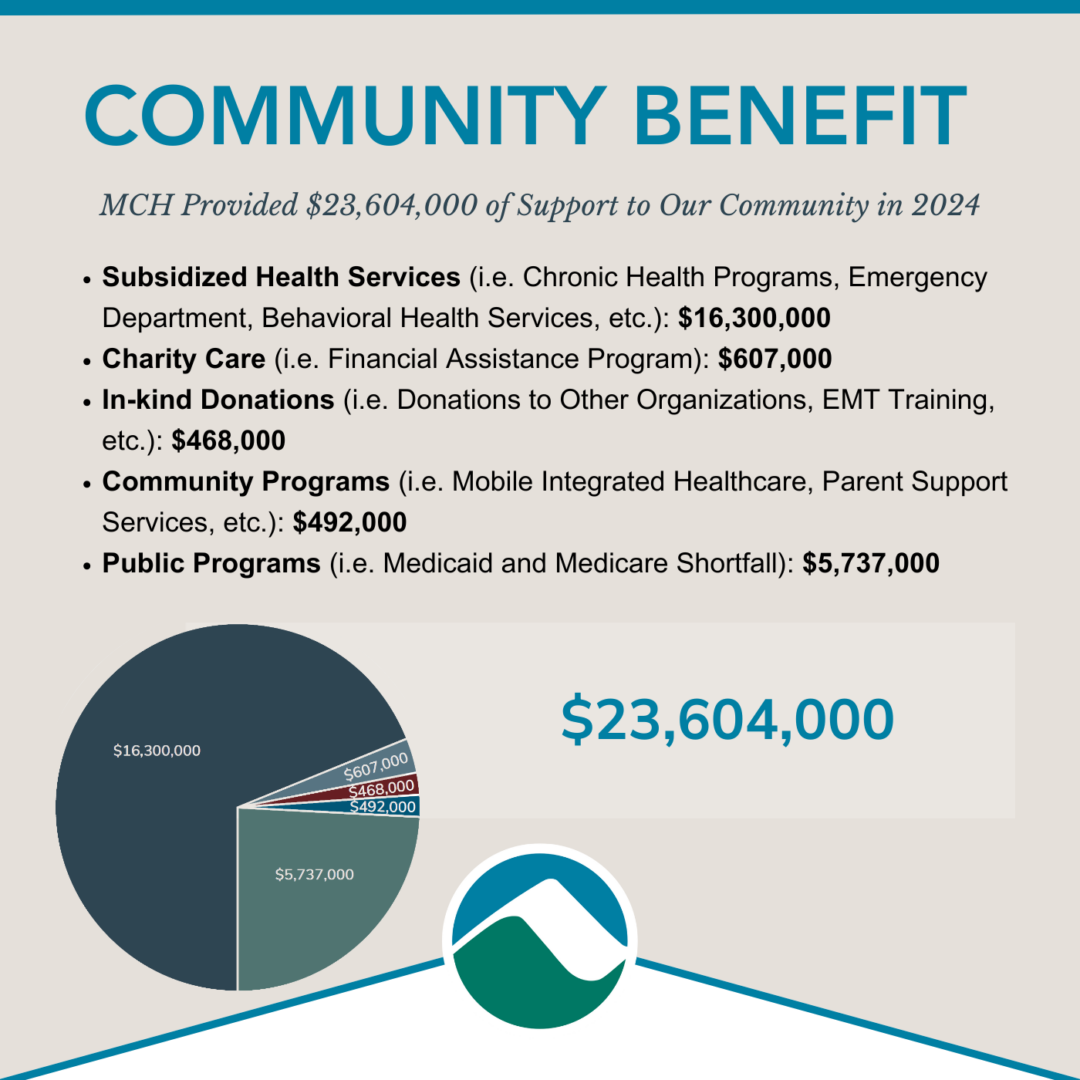

Community Benefits

Your support allows us to provide community benefits and programs.

Improving Patient Experiences

Your gifts help us to renovate our patient care areas to give our patients the best experience while receiving care at our hospital.

New Programs & Services

Your support helps us to develop new programs and services to meet the ever changing needs of our community.

How Your Gifts Have Helped

Planned Giving Options

Your will or estate plan reflects your values and goals. Many people include charity as a part of their will or trust, believing that giving back to others makes our world a better place.

Planned Gifts range in size from $1,000 to $1,000,000 or more.

The Parmelee Society: Benefits of Including MCH in your Will or Estate Planning

- The Parmelee Society honors individuals who have included the hospital in their will or estate plan.

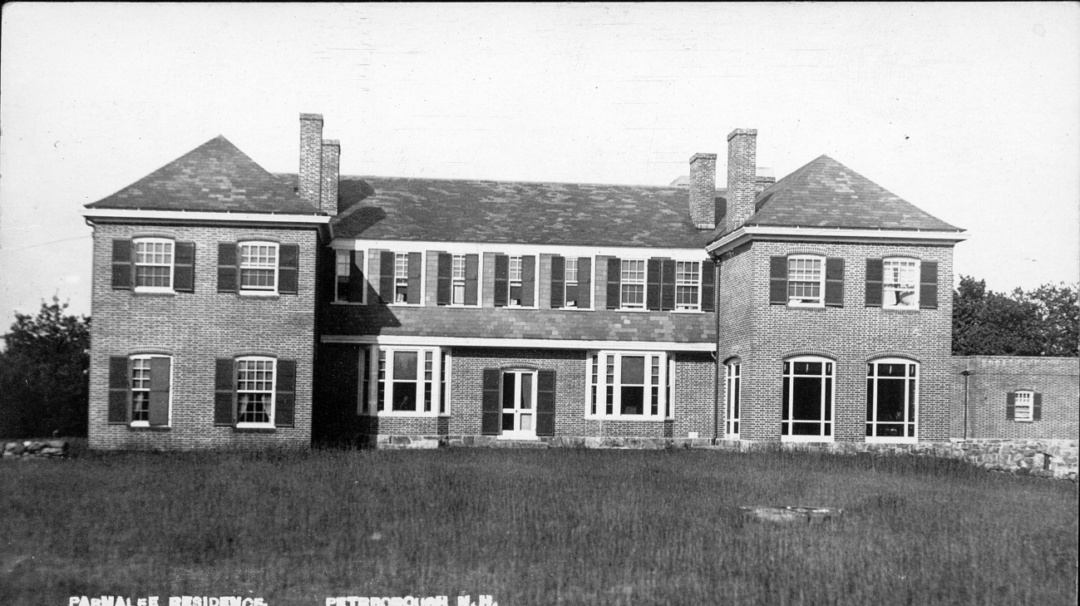

- As a member, you will join a hundred year tradition of supporting community health care , just like Mr. Robert Parmelee did in 1919 when he donated his summer home to the town of Peterborough, in memory of his late wife Alice, to become the first “The Peterboro Hospital”.

- Members receive a special invitation to our annual Parmelee Society reception with our hospital leaders and Trustees

- Parmelee Society members are recognized in our Annual Report and on our giving wall in the main lobby.

Listed below are several ways to make a planned gift. For more information, please contact Laura Gingras, VP of Philanthropy and Community Relations at Laura.Gingras@mchmail.org or 603-924-4666 or LeeAnn Moore, Philanthropy Director at LeeAnn.Moore@mchmail.org or 603-924-1700.

Making a bequest

- The most common way to include MCH would be by adding a few simple sentences in your Last Will and Testament. Simply ask your estate planning professional to add the following language to your will:

“I give to Monadnock Community Hospital, Peterborough, NH, ____percentage of my estate (or the sum of $____) for its general uses and purposes.”

Retirement Plan Assets

Name MCH as a beneficiary of your retirement plan:

Most retirement plan assets such as individual retirement accounts (IRAs) and 401(k)s are subject to taxation when passed to heirs. Retirement plan assets are a great option for charitable gifts. Up to 100% of your retirement plan assets can be transferred to MCH free of all taxes. To name MCH as the beneficiary, first consult with your adviser, then instruct the plan administrator of your decision and simply complete a change of beneficiary form

For more information about all estate planning options, gifts of stock, gifts of real estate, and other giving options please contact Laura Gingras or LeeAnn Moore.

Charitable Gift Annuities

The benefits of creating a Charitable Gift Annuity include:

- You will receive lifetime payments for you or a loved one

- You can take advantage of a charitable tax deduction

- Please contact Laura Gingras or LeeAnn Moore for more information

Real Estate

The benefits of making an outright or partial gift of real estate include:

- Secure a tax deduction based on the fair market value of the property

- There is no capital-gains tax liability on the transfer

Use your IRA Distribution to make a gift

Are you over 70 1/2 and taking a Required Minimum Distribution (RMD) from your IRA? DO you plan on making any charitable gifts this year?

If so, you can direct all or part of your RMD (up to $100,000) to MCH, thanks to the Protecting Americans from Tax Hikes Act of 2015.

Use stocks or mutual funds to make a gift

If you have investments that have appreciated in value, you may want to consider gifting such assets to maximize your charitable gift and tax benefit.

Gifting investments that have appreciated in value allows you to deduct the fair market value of those securities as a charitable gift and you could avoid capital gains tax that would have resulted if you sold the investment. By donating the appreciated investment, you will receive more benefit than selling it and making a cash gift.

Donating stocks and securities is easy to do and can make a huge impact on ensuring access to high quality healthcare close to home. To transfer gifts of appreciated securities to MCH, have your broker contact Anna Highter at RBC Wealth Management, at 603-924-3306 or Anna.highter@rbc.com and Laura Gingras at MCH, at 603-924-4666 or Laura.Gingras@mchmail.org.

Use the following information:

Account #: 301-45529

DCT #: 235

FBO: Monadnock Community Hospital

MCH Tax ID: 02-0222157

Array

(

[section_title] =>

[section_text] =>

[posts_selection] => auto_taxonomy_terms

[section_posts] => Array

(

)

[posts_limit] => 6

[post_type] => tribe_events

[taxonomy] => tag

[terms] => giving

[section_id] => post-grid-13

)

Array

(

[section_title] =>

[section_text] =>

[posts_selection] => auto_taxonomy_terms

[section_posts] => Array

(

[0] => WP_Post Object

(

[ID] => 40278

[post_author] => 9192204

[post_date] => 2025-06-20 11:00:11

[post_date_gmt] => 2025-06-20 15:00:11

[post_content] =>

[post_title] => 2025 DAISY Award Ceremony Honors Extraordinary Nurses

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => the-daisy-award-2025

[to_ping] =>

[pinged] =>

[post_modified] => 2025-06-20 13:44:47

[post_modified_gmt] => 2025-06-20 17:44:47

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=40278

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[1] => WP_Post Object

(

[ID] => 40275

[post_author] => 9192204

[post_date] => 2025-06-09 11:00:43

[post_date_gmt] => 2025-06-09 15:00:43

[post_content] =>

[post_title] => Laura Moran Receives Prestigious Clint Jones Nursing Award

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => clint-jones-award-2025

[to_ping] =>

[pinged] =>

[post_modified] => 2025-06-09 11:21:43

[post_modified_gmt] => 2025-06-09 15:21:43

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=40275

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[2] => WP_Post Object

(

[ID] => 40213

[post_author] => 9192204

[post_date] => 2025-05-27 11:51:47

[post_date_gmt] => 2025-05-27 15:51:47

[post_content] =>

[post_title] => NH Gives 2025: Support Local Nonprofits in the Monadnock Region

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => nh-gives-2025

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-27 12:58:18

[post_modified_gmt] => 2025-05-27 16:58:18

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=40213

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[3] => WP_Post Object

(

[ID] => 40075

[post_author] => 9192204

[post_date] => 2025-05-07 08:46:27

[post_date_gmt] => 2025-05-07 12:46:27

[post_content] =>

[post_title] => Progress with Purpose: 2025 Community Report

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => community-report-2025

[to_ping] =>

[pinged] =>

[post_modified] => 2025-06-14 17:50:54

[post_modified_gmt] => 2025-06-14 21:50:54

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=40075

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[4] => WP_Post Object

(

[ID] => 40103

[post_author] => 9192204

[post_date] => 2025-05-01 14:03:50

[post_date_gmt] => 2025-05-01 18:03:50

[post_content] =>

[post_title] => Uncommon Care, Close to Home: The Unger-Clark Story

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => community-report-2025-unger-clark

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-01 14:42:30

[post_modified_gmt] => 2025-05-01 18:42:30

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=40103

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[5] => WP_Post Object

(

[ID] => 40071

[post_author] => 9192204

[post_date] => 2025-04-29 16:41:34

[post_date_gmt] => 2025-04-29 20:41:34

[post_content] =>

[post_title] => Community Benefits 2025: Strengthening Health, Together

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => community-benefits-2025

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-01 14:43:43

[post_modified_gmt] => 2025-05-01 18:43:43

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=40071

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[6] => WP_Post Object

(

[ID] => 39426

[post_author] => 9192204

[post_date] => 2025-01-15 13:47:34

[post_date_gmt] => 2025-01-15 18:47:34

[post_content] =>

[post_title] => Announcing the 2024 Patricia Boyd Nursing Scholarship Recipients

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => nursing-scholarship-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2025-01-31 13:42:04

[post_modified_gmt] => 2025-01-31 18:42:04

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=39426

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[7] => WP_Post Object

(

[ID] => 39412

[post_author] => 9192204

[post_date] => 2025-01-14 10:14:21

[post_date_gmt] => 2025-01-14 15:14:21

[post_content] =>

[post_title] => Empowering Tomorrow’s Nurses: The Patricia Boyd Nursing Scholarship

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => nursing-scholarship-fund

[to_ping] =>

[pinged] =>

[post_modified] => 2025-03-06 13:53:24

[post_modified_gmt] => 2025-03-06 18:53:24

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/peter-l-gosline-scholarship-fund-2014-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[8] => WP_Post Object

(

[ID] => 39411

[post_author] => 9192204

[post_date] => 2024-11-08 10:14:09

[post_date_gmt] => 2024-11-08 15:14:09

[post_content] =>

[post_title] => Celebrating the 2024 Peter L. Gosline Scholarship Winners

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => peter-gosline-scholarshp-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2025-01-14 09:32:31

[post_modified_gmt] => 2025-01-14 14:32:31

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/peter-gosline-scholarshp-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[9] => WP_Post Object

(

[ID] => 39212

[post_author] => 9192204

[post_date] => 2024-10-16 16:58:07

[post_date_gmt] => 2024-10-16 20:58:07

[post_content] =>

[post_title] => Maximize Your Impact: Support Local Healthcare with an IRA RMD Contribution

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => charitable-contribution-with-ira-rmd

[to_ping] =>

[pinged] =>

[post_modified] => 2024-10-28 12:30:15

[post_modified_gmt] => 2024-10-28 16:30:15

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/end-of-year-giving-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[10] => WP_Post Object

(

[ID] => 39066

[post_author] => 9192204

[post_date] => 2024-10-01 12:37:17

[post_date_gmt] => 2024-10-01 16:37:17

[post_content] =>

[post_title] => A Day of Golf and Giving: MCH’s 28th Annual Fall Foliage Golf Classic

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => mch-golf-classic-success-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2024-10-01 16:19:35

[post_modified_gmt] => 2024-10-01 20:19:35

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/mch-golf-classic-success-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[11] => WP_Post Object

(

[ID] => 38894

[post_author] => 9192204

[post_date] => 2024-09-21 14:59:13

[post_date_gmt] => 2024-09-21 18:59:13

[post_content] =>

[post_title] => Handmade Comfort: Local Crafters Bring Joy to Children in Our Community

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => handmade-comfort-local-crafters-bring-joy-to-children-in-our-community

[to_ping] =>

[pinged] =>

[post_modified] => 2024-09-20 14:59:23

[post_modified_gmt] => 2024-09-20 18:59:23

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38894

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[12] => WP_Post Object

(

[ID] => 38412

[post_author] => 9192204

[post_date] => 2024-08-07 14:52:08

[post_date_gmt] => 2024-08-07 18:52:08

[post_content] =>

[post_title] => Phyllis Scott: A Legacy of Love

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => remembering-phyllis-scott

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-12 14:59:03

[post_modified_gmt] => 2024-08-12 18:59:03

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38412

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[13] => WP_Post Object

(

[ID] => 38374

[post_author] => 9192204

[post_date] => 2024-08-04 11:23:33

[post_date_gmt] => 2024-08-04 15:23:33

[post_content] =>

[post_title] => MCH Community Benefits Program 2024: Making a Difference Together

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => community-benefits-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2025-04-29 17:06:53

[post_modified_gmt] => 2025-04-29 21:06:53

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38374

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[14] => WP_Post Object

(

[ID] => 38052

[post_author] => 9192204

[post_date] => 2024-07-10 09:23:34

[post_date_gmt] => 2024-07-10 13:23:34

[post_content] =>

[post_title] => Investing in Our Community: How MCH Provided Over $18 Million in Support in 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => investing-in-our-community-how-mch-provided-over-18-million-in-support-in-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-19 09:33:54

[post_modified_gmt] => 2025-05-19 13:33:54

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38052

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[15] => WP_Post Object

(

[ID] => 37979

[post_author] => 9192204

[post_date] => 2024-06-20 14:10:33

[post_date_gmt] => 2024-06-20 18:10:33

[post_content] =>

[post_title] => Honoring Compassion: 2024 DAISY Award Ceremony Celebrates Nursing Excellence

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => the-daisy-award-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2025-06-04 11:27:10

[post_modified_gmt] => 2025-06-04 15:27:10

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/the-daisy-award-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[16] => WP_Post Object

(

[ID] => 37919

[post_author] => 9192204

[post_date] => 2024-06-11 09:18:09

[post_date_gmt] => 2024-06-11 13:18:09

[post_content] =>

[post_title] => Join the NH Gives Movement and Make a Difference in Your Community

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => nh-gives-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-27 17:00:52

[post_modified_gmt] => 2024-08-27 21:00:52

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37919

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[17] => WP_Post Object

(

[ID] => 38370

[post_author] => 9192204

[post_date] => 2024-05-15 10:47:23

[post_date_gmt] => 2024-05-15 14:47:23

[post_content] =>

[post_title] => Heartfelt Stories - Clement Family Legacy

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => community-report-2024-clement

[to_ping] =>

[pinged] =>

[post_modified] => 2024-10-01 12:56:34

[post_modified_gmt] => 2024-10-01 16:56:34

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38370

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[18] => WP_Post Object

(

[ID] => 38293

[post_author] => 9192204

[post_date] => 2024-05-14 09:48:42

[post_date_gmt] => 2024-05-14 13:48:42

[post_content] =>

[post_title] => Entering a New Century of Care: 2024 Community Report

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => community-report-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-19 09:21:32

[post_modified_gmt] => 2025-05-19 13:21:32

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/entering-a-new-century-of-care-2024-community-report-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[19] => WP_Post Object

(

[ID] => 37302

[post_author] => 9192204

[post_date] => 2024-02-12 19:21:49

[post_date_gmt] => 2024-02-13 00:21:49

[post_content] =>

[post_title] => MCH Fall Foliage Golf Classic 2024

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => mch-fall-foliage-golf-classic-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2025-03-06 11:56:06

[post_modified_gmt] => 2025-03-06 16:56:06

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37302

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[20] => WP_Post Object

(

[ID] => 37209

[post_author] => 9192204

[post_date] => 2024-01-23 17:59:05

[post_date_gmt] => 2024-01-23 22:59:05

[post_content] =>

Securing a Legacy of Compassionate Care: Explore Planned Giving with The Parmelee Society

Your will or estate plan is a testament to your values and aspirations. For many, the inclusion of charitable giving in these plans is a powerful way to contribute to a better world for future generations.

Planned Gifts come in various sizes, ranging from $1,000 to $1,000,000 or more, providing individuals with diverse options for making a lasting impact. These options include making a bequest, utilizing retirement plan assets, exploring charitable gift annuities, donating real estate, or even using stocks and mutual funds for charitable contributions.

The Parmelee Society: Honoring Your Commitment to Community Health

The Parmelee Society is a distinguished group that recognizes and honors individuals who have chosen to include Monadnock Community Hospital (MCH) in their will or estate plan. Embracing a legacy that spans a hundred years, this society embodies a commitment to supporting community healthcare, mirroring the spirit of philanthropy displayed by Mr. Robert Parmelee in 1919.

Mr. Parmelee's legacy began when he generously donated his summer home to the town of Peterborough, establishing the inaugural "Peterboro Hospital" in memory of his late wife, Alice. Today, the Parmelee Society carries forward this tradition of altruism.

A Tradition of Appreciation and Recognition: Benefits of Including MCH in your Will or Estate Planning

As a valued member of The Parmelee Society, you will experience a host of benefits, including a special invitation to our annual Parmelee Society reception. This exclusive event provides an opportunity to connect with our hospital leaders and Trustees, fostering a sense of community among like-minded individuals dedicated to advancing healthcare in the Monadnock Region.

In addition to the reception, Parmelee Society members are duly recognized in our Annual Report and prominently displayed on our giving wall in the main lobby. This public acknowledgment serves as a testament to your commitment and inspires others to follow in your philanthropic footsteps.

Get Involved: Contact Us Today

For those interested in joining The Parmelee Society and securing a legacy of compassionate care, we invite you to contact Laura Gingras, VP of Philanthropy and Community Relations, at Laura.Gingras@MCHMail.org or 603-924-4666. You may also reach out to LeeAnn Moore, Philanthropy Director, at LeeAnn.Moore@MCHMail.org or 603-924-1700.

Take the first step towards making a lasting impact on community health – explore planned giving options with The Parmelee Society.

Learn more at MCHGiving.org

“I support MCH because they are devoted to providing the Monadnock Region with world-class medical care. If it was a hotel, it would get a five-star rating.” — Charlie Palmer, Jaffrey

[post_title] => The Parmelee Society: Securing a Legacy of Compassionate Care

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => parmelee-society-2024

[to_ping] =>

[pinged] =>

https://vimeo.com/898176140

[post_modified] => 2024-08-21 11:34:51

[post_modified_gmt] => 2024-08-21 15:34:51

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/your-hospital-february-2024-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[21] => WP_Post Object

(

[ID] => 37150

[post_author] => 9192204

[post_date] => 2023-12-20 14:01:14

[post_date_gmt] => 2023-12-20 19:01:14

[post_content] =>

[post_title] => The Parmelee Society: Securing a Legacy of Compassionate Care

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => parmelee-society-2024

[to_ping] =>

[pinged] =>

https://vimeo.com/898176140

[post_modified] => 2024-08-21 11:34:51

[post_modified_gmt] => 2024-08-21 15:34:51

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/your-hospital-february-2024-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[21] => WP_Post Object

(

[ID] => 37150

[post_author] => 9192204

[post_date] => 2023-12-20 14:01:14

[post_date_gmt] => 2023-12-20 19:01:14

[post_content] =>  Our Community Spotlight series shines a light on the incredible organizations and initiatives shaping the Monadnock region. From addressing mental health to combating hunger, these inspiring stories highlight the power of community connection and the difference we can make together.

In a heartwarming display of community support, local Beautycounter independent consultants collaborated with the community to donate all-natural body products to the Oncology and Infusion Therapy Center at Monadnock Community Hospital. They donated nearly 80 handmade bags, each valued at $40, containing nourishing lip gloss, body butters, soothing teas, and personalized notes of encouragement. These donations aim to provide comfort and relief to cancer patients undergoing treatment. Financial contributions from the community, along with independent Beautycounter consultants Denise Chatel, Ellen Smith, and Ruth Clark, made these donations possible. To learn more about contributing to Monadnock Community Hospital, visit MCHGiving.org.

Our Community Spotlight series shines a light on the incredible organizations and initiatives shaping the Monadnock region. From addressing mental health to combating hunger, these inspiring stories highlight the power of community connection and the difference we can make together.

In a heartwarming display of community support, local Beautycounter independent consultants collaborated with the community to donate all-natural body products to the Oncology and Infusion Therapy Center at Monadnock Community Hospital. They donated nearly 80 handmade bags, each valued at $40, containing nourishing lip gloss, body butters, soothing teas, and personalized notes of encouragement. These donations aim to provide comfort and relief to cancer patients undergoing treatment. Financial contributions from the community, along with independent Beautycounter consultants Denise Chatel, Ellen Smith, and Ruth Clark, made these donations possible. To learn more about contributing to Monadnock Community Hospital, visit MCHGiving.org.

Pictured from left to right: Denise Chatel, Ellen Smith, and Ruth Clark smile bright as they donate gift bags for Oncology patients

[gallery columns="2" ids="37110,37111" orderby="rand"]

[post_title] => Community Compassion: Local Beauty Consultants Extend Comfort to Cancer Patients

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => oncology-donation-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-01-10 10:34:38

[post_modified_gmt] => 2025-01-10 15:34:38

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37150

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[22] => WP_Post Object

(

[ID] => 36918

[post_author] => 9192204

[post_date] => 2023-11-24 13:44:20

[post_date_gmt] => 2023-11-24 18:44:20

[post_content] =>

[post_title] => MCH Giving Tuesday 2024: Support New Beginnings

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => giving-tuesday-at-monadnock-community-hospital-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2024-12-09 15:34:18

[post_modified_gmt] => 2024-12-09 20:34:18

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=36918

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[23] => WP_Post Object

(

[ID] => 38880

[post_author] => 9192204

[post_date] => 2023-11-15 15:19:21

[post_date_gmt] => 2023-11-15 20:19:21

[post_content] =>

[post_title] => End-of-Year Giving: Making a Difference Together

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => end-of-year-giving-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-23 15:27:19

[post_modified_gmt] => 2024-08-23 19:27:19

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38880

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[24] => WP_Post Object

(

[ID] => 39434

[post_author] => 9192204

[post_date] => 2023-11-13 17:25:11

[post_date_gmt] => 2023-11-13 22:25:11

[post_content] => In the heart of Peterborough, New Hampshire, Monadnock Community Hospital (MCH) stands as a beacon of hope and healing. As we approach Giving Tuesday, a day dedicated to generosity and community support, let's take a moment to reflect on MCH's profound impact on our community. Over the past century, MCH has been committed to providing compassionate care and making a difference in the lives of those in need.

Pictured from left to right: Denise Chatel, Ellen Smith, and Ruth Clark smile bright as they donate gift bags for Oncology patients

[gallery columns="2" ids="37110,37111" orderby="rand"]

[post_title] => Community Compassion: Local Beauty Consultants Extend Comfort to Cancer Patients

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => oncology-donation-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-01-10 10:34:38

[post_modified_gmt] => 2025-01-10 15:34:38

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37150

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[22] => WP_Post Object

(

[ID] => 36918

[post_author] => 9192204

[post_date] => 2023-11-24 13:44:20

[post_date_gmt] => 2023-11-24 18:44:20

[post_content] =>

[post_title] => MCH Giving Tuesday 2024: Support New Beginnings

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => giving-tuesday-at-monadnock-community-hospital-2024

[to_ping] =>

[pinged] =>

[post_modified] => 2024-12-09 15:34:18

[post_modified_gmt] => 2024-12-09 20:34:18

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=36918

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[23] => WP_Post Object

(

[ID] => 38880

[post_author] => 9192204

[post_date] => 2023-11-15 15:19:21

[post_date_gmt] => 2023-11-15 20:19:21

[post_content] =>

[post_title] => End-of-Year Giving: Making a Difference Together

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => end-of-year-giving-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-23 15:27:19

[post_modified_gmt] => 2024-08-23 19:27:19

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38880

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[24] => WP_Post Object

(

[ID] => 39434

[post_author] => 9192204

[post_date] => 2023-11-13 17:25:11

[post_date_gmt] => 2023-11-13 22:25:11

[post_content] => In the heart of Peterborough, New Hampshire, Monadnock Community Hospital (MCH) stands as a beacon of hope and healing. As we approach Giving Tuesday, a day dedicated to generosity and community support, let's take a moment to reflect on MCH's profound impact on our community. Over the past century, MCH has been committed to providing compassionate care and making a difference in the lives of those in need.

The Community Impact of MCH

MCH has been a pillar of support for our community, with a long-standing commitment to caring for the people of Peterborough and its surrounding areas. Through our various community benefit initiatives, MCH has positively impacted the lives of countless individuals and families.

Financial Assistance Program

One of the key initiatives undertaken by MCH is our Financial Assistance Program. In 2022 alone, MCH contributed $485,000 towards this program, providing a safety net for those facing financial hardships. This program ensures that individuals in need have access to the healthcare services they require, regardless of their financial situation.

Community Programs

MCH understands the importance of community engagement and has invested $268,000 in various community programs. These programs aim to promote health and well-being, educate the community about important healthcare topics, and foster a sense of togetherness. By organizing events, workshops, and support groups, MCH actively engages with the community and addresses their specific healthcare needs.

Subsidized Health Services

Access to affordable healthcare services is crucial, and MCH recognizes this need. Through our subsidized health services, MCH has contributed $8,279,000 towards ensuring that essential healthcare services are accessible to everyone. This includes providing affordable treatments, medications, and specialized care for those who may not have the means to afford them otherwise.

Public Programs

MCH has been actively involved in public health initiatives, contributing $7,499,000 towards various programs aimed at improving the overall health of the community. These programs focus on preventive care, health education, and disease management, empowering individuals to take control of their health and well-being.

Making a Difference Through Generosity

Your generous contributions to MCH have made a significant impact on the lives of individuals and families in our community. Let's take a closer look at how your gifts have made a difference.

-

-

Financial Assistance Program:

-

-

-

New Beginnings:

-

-

-

Emergency Department Care:

-

A Story of Resilience and Hope

One beneficiary of MCH's Community Benefit Program is Francis Savoie, a single father and former oil truck driver. Francis was diagnosed with severe rheumatoid arthritis and degenerative disc disease at the age of 42, which threatened his ability to work and provide for his family. However, regular infusion treatments at MCH's Oncology and Infusion Center brought relief. "The infusion treatments really helped," says Francis, "but I had trouble affording my co-pays. MCH helped me through their Financial Assistance Program." The compassionate staff at MCH fought for Francis, providing him with the financial support he needed to continue his treatments. The kindness and care he received at MCH gave him the support and courage to face the challenges of his medical condition. This story is a testament to the impact MCH has had on individuals and families in our community. Your contributions, both big and small, have helped shape these stories and create a healthier, more compassionate community for generations to come.Building a Healthier Community Together

As we celebrate Giving Tuesday, let's take pride in the fact that our hospital, Monadnock Community Hospital, has been a beacon of compassion for a century. Through our various community benefit initiatives, they have touched the lives of countless individuals and families, ensuring that vital health services are accessible to everyone. Your generosity and support have played a crucial role in making this possible. By continuing to give, we can build a healthier, more compassionate community where everyone has access to the care they need. Together, let's make a difference on Giving Tuesday and beyond. Join us in celebrating Giving Tuesday at Monadnock Community Hospital! Discover a century of compassionate care in the heart of Peterborough, New Hampshire. Learn how your contributions have shaped the lives of countless individuals and families through MCH's Community Benefit Initiatives. From the Financial Assistance Program to supporting community programs and subsidized health services, your generosity has made a significant impact. Explore stories of resilience and hope, like Francis Savoie's, and see firsthand how your support creates a healthier, more compassionate community. Together, let's continue building a legacy of care and making a difference on Giving Tuesday and beyond - donate now. [post_title] => Giving Tuesday at Monadnock Community Hospital 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => giving-tuesday-at-monadnock-community-hospital-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-11-13 17:39:01

[post_modified_gmt] => 2024-11-13 22:39:01

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/giving-tuesday-at-monadnock-community-hospital-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[25] => WP_Post Object

(

[ID] => 38899

[post_author] => 9192204

[post_date] => 2023-09-28 15:45:09

[post_date_gmt] => 2023-09-28 19:45:09

[post_content] =>

[post_title] => Celebrating Excellence: The 2023 Peter Gosline Scholarship Awardees

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => peter-gosline-scholarshp-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-11-09 14:21:38

[post_modified_gmt] => 2024-11-09 19:21:38

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38899

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[26] => WP_Post Object

(

[ID] => 38897

[post_author] => 9192204

[post_date] => 2023-09-26 15:21:49

[post_date_gmt] => 2023-09-26 19:21:49

[post_content] =>

[post_title] => MCH’s 27th Annual Golf Tournament: A Success Story

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => mch-golf-classic-success-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-26 15:28:44

[post_modified_gmt] => 2024-08-26 19:28:44

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/mch-fall-foliage-golf-classic-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[27] => WP_Post Object

(

[ID] => 38896

[post_author] => 9192204

[post_date] => 2023-09-26 15:15:33

[post_date_gmt] => 2023-09-26 19:15:33

[post_content] =>

[post_title] => Make a Difference with Your IRA: A Tax-Free Way to Support MCH

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => make-a-difference-with-your-ira-a-tax-free-way-to-support-monadnock-community-hospital

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-27 17:10:57

[post_modified_gmt] => 2024-08-27 21:10:57

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38896

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[28] => WP_Post Object

(

[ID] => 37299

[post_author] => 9192204

[post_date] => 2023-07-01 18:42:40

[post_date_gmt] => 2023-07-01 22:42:40

[post_content] =>

[post_title] => MCH Fall Foliage Golf Classic 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => mch-fall-foliage-golf-classic-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-19 14:07:22

[post_modified_gmt] => 2025-05-19 18:07:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37299

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[29] => WP_Post Object

(

[ID] => 37154

[post_author] => 9192204

[post_date] => 2023-06-21 14:24:31

[post_date_gmt] => 2023-06-21 18:24:31

[post_content] => 100 years ago today we opened our doors to care for our community and what better way to celebrate than with our 8th Annual DAISY Award Ceremony!

MCH is a part of more than 5,400 healthcare facilities and schools around the globe who participate in the DAISY Award program, which honors nurses who demonstrate excellence and provide extraordinary compassionate care to their patients and families.

This year, 14 individual nurses and all of the nurses of the Medical Surgical Unit were nominated by either a patient, family member or colleague.

We are so pleased to announce that the 2023 DAISY Award Winners are Donna Infante, RN and Clayton Kuusisto, RN both of the Sarah Hogate Bacon Emergency Department. It is the skilled care and dedication to exceptional nursing that has sustained MCH for 100 years!

Join us in congratulating the nominees and winners!

To Learn More About The DAISY Award or To Nominate an MCH Nurse, Please Visit: https://monadnockcommunityhospital.com/about-us/patient-experience/nominate-a-nurse-for-the-daisy-award/

[post_title] => Giving Tuesday at Monadnock Community Hospital 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => giving-tuesday-at-monadnock-community-hospital-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-11-13 17:39:01

[post_modified_gmt] => 2024-11-13 22:39:01

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/giving-tuesday-at-monadnock-community-hospital-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[25] => WP_Post Object

(

[ID] => 38899

[post_author] => 9192204

[post_date] => 2023-09-28 15:45:09

[post_date_gmt] => 2023-09-28 19:45:09

[post_content] =>

[post_title] => Celebrating Excellence: The 2023 Peter Gosline Scholarship Awardees

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => peter-gosline-scholarshp-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-11-09 14:21:38

[post_modified_gmt] => 2024-11-09 19:21:38

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38899

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[26] => WP_Post Object

(

[ID] => 38897

[post_author] => 9192204

[post_date] => 2023-09-26 15:21:49

[post_date_gmt] => 2023-09-26 19:21:49

[post_content] =>

[post_title] => MCH’s 27th Annual Golf Tournament: A Success Story

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => mch-golf-classic-success-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-26 15:28:44

[post_modified_gmt] => 2024-08-26 19:28:44

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/mch-fall-foliage-golf-classic-2023-copy/

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[27] => WP_Post Object

(

[ID] => 38896

[post_author] => 9192204

[post_date] => 2023-09-26 15:15:33

[post_date_gmt] => 2023-09-26 19:15:33

[post_content] =>

[post_title] => Make a Difference with Your IRA: A Tax-Free Way to Support MCH

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => make-a-difference-with-your-ira-a-tax-free-way-to-support-monadnock-community-hospital

[to_ping] =>

[pinged] =>

[post_modified] => 2024-08-27 17:10:57

[post_modified_gmt] => 2024-08-27 21:10:57

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=38896

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[28] => WP_Post Object

(

[ID] => 37299

[post_author] => 9192204

[post_date] => 2023-07-01 18:42:40

[post_date_gmt] => 2023-07-01 22:42:40

[post_content] =>

[post_title] => MCH Fall Foliage Golf Classic 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => mch-fall-foliage-golf-classic-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-05-19 14:07:22

[post_modified_gmt] => 2025-05-19 18:07:22

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37299

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

[29] => WP_Post Object

(

[ID] => 37154

[post_author] => 9192204

[post_date] => 2023-06-21 14:24:31

[post_date_gmt] => 2023-06-21 18:24:31

[post_content] => 100 years ago today we opened our doors to care for our community and what better way to celebrate than with our 8th Annual DAISY Award Ceremony!

MCH is a part of more than 5,400 healthcare facilities and schools around the globe who participate in the DAISY Award program, which honors nurses who demonstrate excellence and provide extraordinary compassionate care to their patients and families.

This year, 14 individual nurses and all of the nurses of the Medical Surgical Unit were nominated by either a patient, family member or colleague.

We are so pleased to announce that the 2023 DAISY Award Winners are Donna Infante, RN and Clayton Kuusisto, RN both of the Sarah Hogate Bacon Emergency Department. It is the skilled care and dedication to exceptional nursing that has sustained MCH for 100 years!

Join us in congratulating the nominees and winners!

To Learn More About The DAISY Award or To Nominate an MCH Nurse, Please Visit: https://monadnockcommunityhospital.com/about-us/patient-experience/nominate-a-nurse-for-the-daisy-award/

[post_title] => The DAISY Award Ceremony 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => the-daisy-award-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-06-04 11:27:06

[post_modified_gmt] => 2025-06-04 15:27:06

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37154

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

)

[posts_limit] => 30

[post_type] => post

[taxonomy] => tag

[terms] => giving

[section_id] => post-grid-14

)

[post_title] => The DAISY Award Ceremony 2023

[post_excerpt] =>

[post_status] => publish

[comment_status] => closed

[ping_status] => closed

[post_password] =>

[post_name] => the-daisy-award-2023

[to_ping] =>

[pinged] =>

[post_modified] => 2025-06-04 11:27:06

[post_modified_gmt] => 2025-06-04 15:27:06

[post_content_filtered] =>

[post_parent] => 0

[guid] => https://monadnockcommunityhospital.com/?p=37154

[menu_order] => 0

[post_type] => post

[post_mime_type] =>

[comment_count] => 0

[filter] => raw

)

)

[posts_limit] => 30

[post_type] => post

[taxonomy] => tag

[terms] => giving

[section_id] => post-grid-14

)

Pictured from left to right: Denise Chatel, Ellen Smith, and Ruth Clark smile bright as they donate gift bags for

Pictured from left to right: Denise Chatel, Ellen Smith, and Ruth Clark smile bright as they donate gift bags for